san francisco sales tax rate history

California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 3 P a g e Note. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents.

Understanding California S Property Taxes

7 Hotel Tax.

. As of January 1 2022 the following 140 California local jurisdictions have a combined sales tax rate in excess of the 200 percent local tax rate cap. 6 Real Property Transfer Tax. The San Francisco sales tax rate is 0.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles. 068 if value is between 250000 and 1000000. 4 rows The current total local sales tax rate in San Francisco CA is 8625.

The 200 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 925 725 statewide tax rate plus the 200 tax rate cap. 20 40 60 80 100 120 140 unemployment rate historical trend. Download all California sales tax rates by zip code.

This is the total of state county and city sales tax rates. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. Secured property taxes are calculated based on real propertys assessed value as determined annually by the Office of the Assessor-Recorder.

The total sales tax rate in any given location can be broken down into state county city and special district rates. 05 if sale value is less than 250000. The San Francisco.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Click here to find other recent sales tax rate changes in California. Historical Tax Rates in California Cities Counties.

Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. Sales and Use Tax Rate Decreases January 1 2017. Effective 101594 rates were.

Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts. Tax rate for nonresidents who work in San Francisco. Select the California city from the list of cities starting with A below to see its current sales tax rate.

California has recent rate changes Thu Jul 01 2021. The secured property tax rate for Fiscal Year 2021-22 is 118248499Secured Property Tax bills are mailed in October. California has a 6 sales tax and San Mateo County collects an additional 025 so the minimum sales tax rate in San Mateo County is 625 not including any city or special district taxes.

The transfer tax rate had been previously unchanged since 1967. Rate changed to 14 effective August 1996. The sales tax amounts in the interactive map above represent only the collections attributable to local Bradley-Burns portion of sales tax from 2011 to 2016.

Fast Easy Tax Solutions. Voterapproved Proposition 30 The Schools and Local Public Safety Protection Act of 2012 which imposed the one quarter of one percent 025 percent temporary statewide sales and use tax rate expires on December 31 2016. And 075 if value is 1000000 or higher.

Apr 01 2021 The current total local sales tax rate in South San Francisco CA is 9750. The 9875 sales tax rate in South San Francisco consists of 6 California state sales. Ad Find Out Sales Tax Rates For Free.

Like the GRT the tax rate depends on the type of business activity from which the gross receipts are earned as follows3. The San Mateo sales tax has been changed within the last year. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page.

8 Parking Tax. The San Francisco Tourism Improvement District sales tax has been. The minimum combined 2022 sales tax rate for San Francisco California is 863.

The San Francisco County California. 1788 rows Presidio San Francisco 8625. The California sales tax rate is currently 6.

The Homelessness Gross Receipts Tax imposes an annual tax in addition to the existing GRT on San Francisco taxable gross receipts above 500000002 Otherwise the tax base is the same as the existing GRT. Next to city indicates incorporated city City Rate County Blossom Valley 9000 Santa Clara Blue Jay 7750. What is the sales tax rate in San Francisco California.

For a full historical description of sales tax rates and beneficiaries in San Francisco and throughout California vist the Board of Equalization. The average sales tax rate in California is 8551. Presidio of Monterey Monterey.

The December 2020. The South San Francisco sales tax has been changed within the last year. As a result effective January 1 2017 the California statewide sales and use tax rate.

This table shows the total sales tax rates for all cities and towns in San. The County sales tax rate is 025. With local taxes the total sales tax rate is between 7250 and 10750.

Data is available annually in order to protect the confidentiality of the sales tax. 4 rows The current total local sales tax rate in South San Francisco CA is 9875. It was raised 0125 from 95 to 9625 in July 2021 and raised 0125 from 925 to 9375 in July 2021.

San Francisco County California Sales Tax Rate 2022 Up to 9875.

The Most And Least Tax Friendly Major Cities In America

2022 Federal State Payroll Tax Rates For Employers

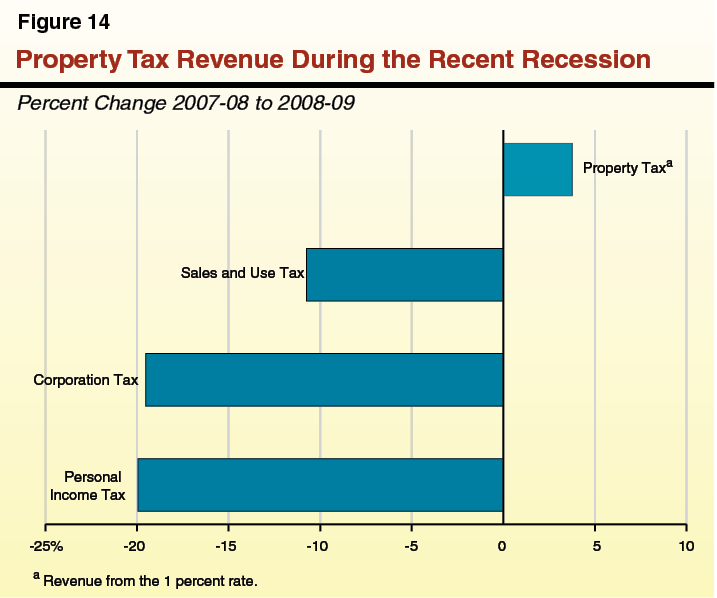

Understanding California S Property Taxes

Understanding California S Property Taxes

Sales Tax Collections City Performance Scorecards

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Are Total Taxes Higher In The Usa Or Europe Quora

States With Highest And Lowest Sales Tax Rates

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Understanding California S Property Taxes

States With Highest And Lowest Sales Tax Rates

Frequently Asked Questions City Of Redwood City

How Do State And Local Sales Taxes Work Tax Policy Center

Housing Market Forecast Homes Condos Apartments 2021 Rents Sales Prices Managecasa

How Do State And Local Sales Taxes Work Tax Policy Center